Cenerus Featured in Bank Director Article Highlighting Key Steps Banks Can Take Today to Improve Their Efficiency Ratio

Cenerus CEO, Sam Rosenfeld, is featured in Bank Director, a leading banking and financial institution resource for executives, senior management and boards, outlining guidance for banks on addressing the most talked about performance indicator right now – the efficiency ratio.

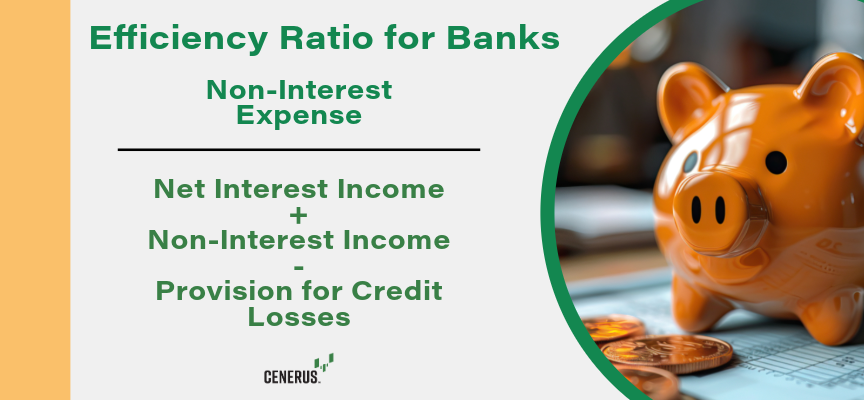

With anticipated relaxation of regulatory pressure, the focus for banks turns to performance – for both competitiveness and the potential for future transactions. The strongest indicator for financial institutions is the Efficiency Ratio, reinforcing that for every dollar of expense a bank must maximize revenue created.

The article outlines the foundational approach of focusing on the borrower vs. the loan as the true asset of the financial institution. Only then, can banks evaluate options that ensure an expanded view of potential profit and services available to their customers. Sam goes on to outline the three ways to immediately impact the efficiency ratio:

- Ensure every piece of data is valuable and contributes to a central picture of the customer.

- Adopt a centralized, fusion-focused approach to gathering data.

- Take a proactive approach to monitoring customers and prompting action.

Treating the customer as the asset and the bank like a business helps drive this focused approach for consistent, stronger performance in a more competitive and performance-focused environment.

Click here to read the full article in Bank Director.

If you’d like to explore how a complete view of your commercial and business customers can create improved profit and lasting performance, reach out to us at Cenerus. Our executive-ready analysis and expertise with a fusion-center approach scales to meet banks where they’re at and deliver immediate impact always focused on driving added profit.

Contact us at [email protected] for more.