Cenerus

C-RATE

THE CENERUS RATING & MONITORING SYSTEM

The Cenerus Rating and Monitoring SystemSM (C-RATESM) Gives Banks and Lenders Up-to-Date Condition, Risk and Outlook for Commercial Loans

Increased uncertainty demands greater knowledge and tools to maximize the value of your commercial borrowers, loans and portfolios.

With market shifts happening daily and many loans significantly underreported missing regular updates and meaningful updated data, lenders need a reliable, impartial way to quickly and confidently assess borrowers and take action.

The Cenerus Rating & Monitoring System (C-RATE) delivers a concise rating summary built on whole-company insights to help lenders better understand their borrowers and loans, and engage earlier – based on triggers – with proactive new services, risk management, or pursuing liquidity.

CENERUS SCORESM FOR CLARITY ON THE

LIKLIHOOD OF LOAN PAYBACK

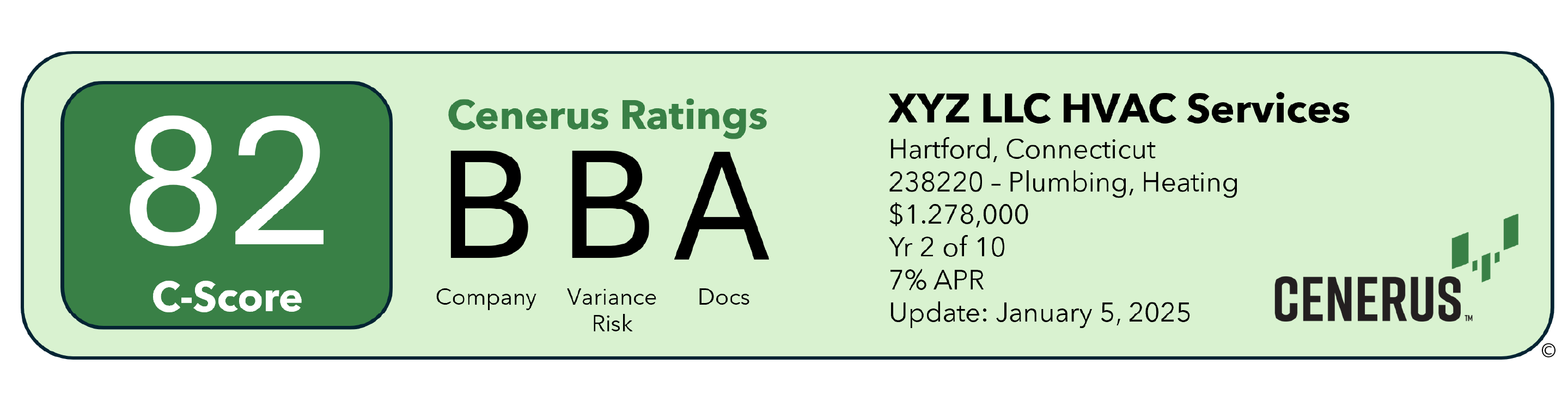

The at-a-glance Cenerus Score (or C-Score) gives a 0-100 score showing the overall quality of the loan from a repayment perspective.

CENERUS RATINGSSM FOR INSIGHT ON THE

COMPANY AND LOAN STRUCTURE

Cenerus Ratings give an A-F grade for the overall Company, Loan Variance Risk and for the strength and completeness of the Loan Documentation.

EXPANDED CONTROL WITH THE AT-A-GLANCE PORTFOLIO VIEW

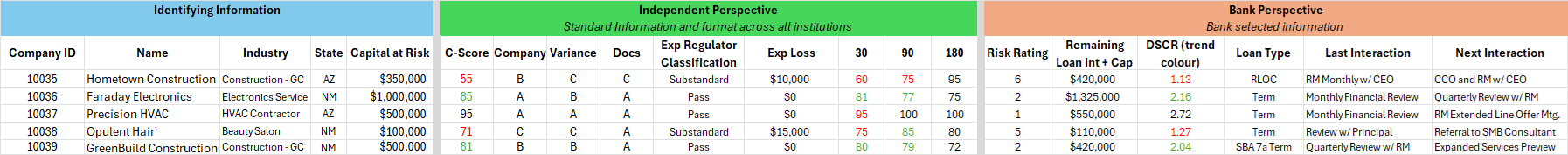

As lenders have more loans reviewed with C-RATE they can deploy the C-RATE Portfolio View. It shows rating trends over time, enables triggers and gives relationship managers and bank executives a customizable, quick update on loan performance, risks and opportunities.

QUICK IMPLEMENTATIONS

Get started with a sample set of ~10 loans to see the impact and value of Cenerus’ approach.

NO TECHNOLOGY OVERHEAD

Fast deployment – this isn’t a technology you have to integrate into your system, so it is easier to utilize and see benefits right away.

RAPID IMPACT

Multiple streams of impact from improved efficiency ratio, proactive identification of threats and opportunities, enhanced liquidity and better position with regulatory inquiries.

Cenerus’ C-RATE Service Significantly Expands Banks and Lenders Capabilities to Proactively Manage Commercial Loans While Improving Performance, Options and Customer Support.